The healthcare payer landscape is witnessing a dramatic transformation. As we move into 2024, payers face challenges to reduce costs while delivering superior member experiences and ensuring efficient operations. Traditional approaches are proving insufficient in today’s dynamic healthcare environment.

e.g. Manual claim processing costs organizations four times more than automated solutions. With healthcare costs rising by 4.1% annually, payers can no longer afford to rely on conventional methods.

Today’s Payer Pain Points

The challenges facing healthcare payers stem from three core areas:

Operational Burden

- Manual claim adjudication processes are resource-intensive and error-prone

- Siloed vendor programs with overlapping objectives create redundancy

- Growing administrative costs due to complex regulatory requirements are eating into margins

Member Experience Gaps

Recent studies show a concerning 14% drop in member satisfaction ratings. The root causes?

- Fragmented communication channels

- Limited personalization in service delivery

- Delayed response times for basic inquiries

- Complex, paper-heavy processes frustrating members

Insurers fail to meet growing demands for transparency, faster claims processing, and personalized communication.

Cost Management Struggles Perhaps most alarming is that up to 25% of total healthcare spend is attributed to waste and improper payments. This stems from:

- Inefficient manual review processes

- Limited fraud detection capabilities

- Missed opportunities for payment optimization

- Complex coordination of benefits

Payers often struggle with identifying fraudulent claims promptly, resulting in significant financial leakage.

The AI-Driven Solution Landscape

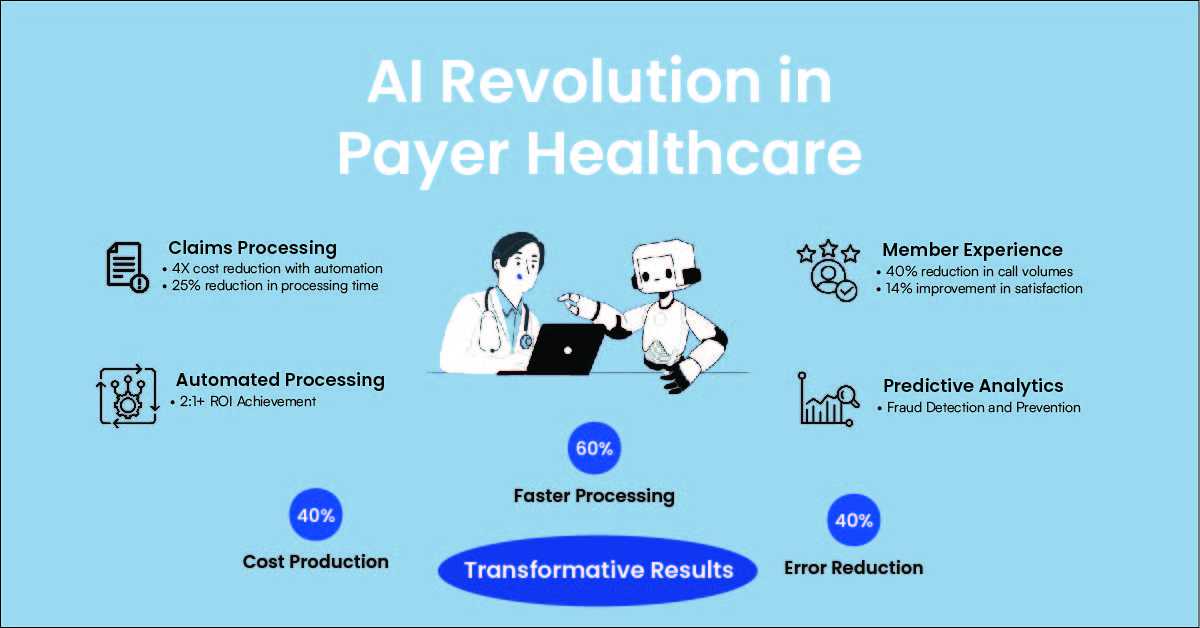

AI can address these inefficiencies by transforming the payer ecosystem through automation, predictive analytics, and fraud detection: Here’s how:

- Smart Claims Management

AI is transforming claims processing. AI-powered tools streamline claims adjudication, reducing the need for human intervention. Predictive analytics can forecast high-dollar claims, identify patterns for fraud, and automate approvals for low-risk cases, drastically cutting costs and improving speed.

Machine learning models can uncover suspicious patterns in claims data, enabling real-time identification of fraudulent activities. By deploying AI-based fraud detection, payers can reduce leakage and save millions annually.

The Impact: Organizations implementing AI-driven claims management report a 2:1+ ROI while significantly improving processing speed.

- Intelligent Care management and Member Engagement

Modern AI Solutions Enable Personalized communications with

- Risk prediction models for high-risk member identification

- Automated appointment scheduling and follow-ups

- AI-driven personalized care plan generation

- Proactive appointment reminders & intervention recommendations

- Smart Service Delivery

- AI-powered customer service with 360-degree member views

- Automated eligibility verification

- Intelligent routing and response systems

- Predictive analytics for member inquiries

The Result: Contact centers using AI report a 40% reduction in call volumes while improving member satisfaction scores.

Measurable Impact

By integrating AI into core processes, payers can achieve up to a 40% reduction in operational costs and see a 2:1 return on investment while enhancing the overall member experience. In addition, they see

- Significant reduction in manual processing costs

- Enhanced fraud detection and prevention capabilities

- Improved member satisfaction through personalized interactions